ERA - Match Payer to Payment

When processing an ERA file, the system will attempt to match the payer by their Tax ID. If there is a single match on the Tax ID, then the matching insurance company will be used when applying the ERA file.

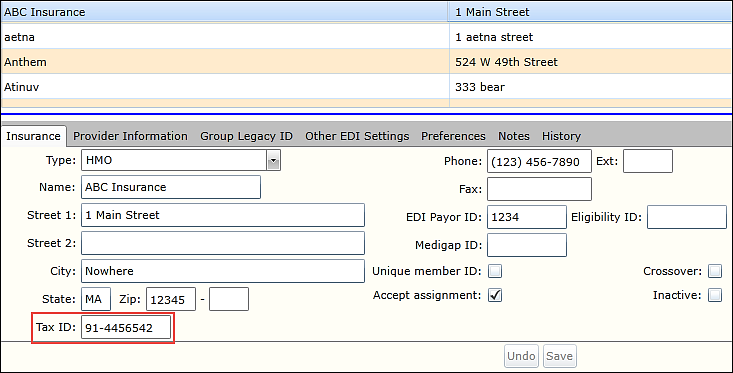

To see the Tax ID field:

- Click on Persons and Institutions | Insurance Companies

- Select insurance company

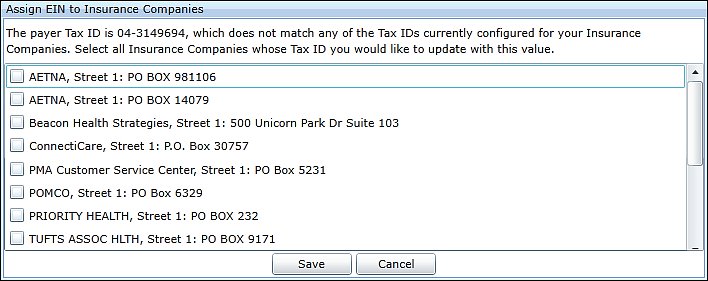

Match Payer by Tax ID: No Tax ID Match

If none of the insurance companies match the Tax ID of the payer in the ERA file, then the user will be prompted to select an insurance company for this ERA file.

Once an ERA file has been processed, the Tax ID will be automatically linked with that payer

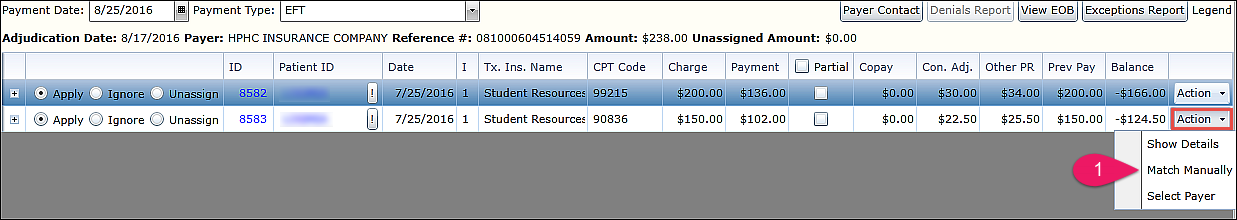

Match Payer by Tax ID: Multiple Tax ID Match

If the Tax ID associated with the payer of the ERA file matches to more than one insurance company in the list, then the system will attempt to automatically select an insurance company to be used.

The user has the option to change that payer by clicking Action | Select Payer

The user will be allowed to change the insurance company used when processing the ERA file

NOTE: The Select Payer option is only available when more than one insurance company exists with the same Tax ID

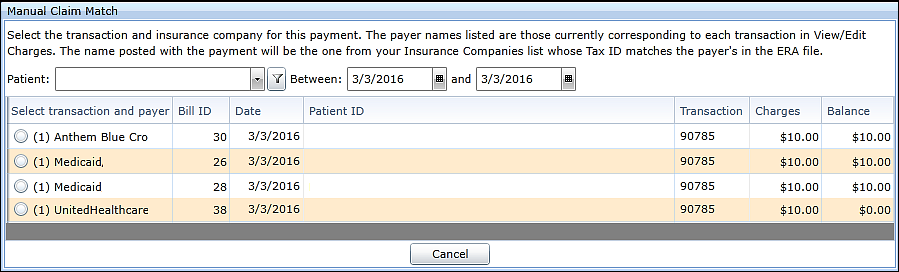

Match Payer Manually

This feature allows a user to manually assign the payer to the payment is being applied.

This is useful for when the insurance companies associated with a given service line has changed since the claim was originally billed and the user wants to ensure that the payment is applied at the correct insurance tier.

To change the insurance tier associated with a given payment, select the Match Manually option from the Action drop down.

The Manual Claim Match page will then open.

Regardless of the insurance company listed, the payment associated with the ERA file will be from the insurance company with the same Tax ID as that of the payer of the ERA file.